.jpg)

| Basics | Investing | Advantages | Types |

| Buying | Ownership | Why Cache Metals | FAQ's |

Precious Metals have been involved in life for thousands of years.For over 3500 years gold has been considered a desirable and worthwhile asset to accumulate and in 2013, the consensus is no different. Gold has always been universally viewed as currency, not just a commodity. In the pre-modern days, coin circulation was a dominant use for gold because it represented power and indefinite insurance for the early leaders who wanted a guaranteed upper hand against any unforeseen economic and political predicaments. Today, Precious Metals are still play a role in our everyday life, Gold, Silver, Platinum and Palladium are used for more than just jewelery and coins, they can also be found in electronics, health care, automotive parts. And because of the many dynamic uses, Precious Metals are more valuable than more realize. Check out the glossary below which further details how Precious Metals are used today.

Precious Metals Glossary

Bullion - Bullion refers to Precious Metals products that are manufactured in a bar, round or ingot form by a refiner or private producer and usually having a purity of at least 99.5% or more.

Bullion Coin - A legal tender coin, produced by a sovereign government, the value of such coin primarily depends on its Precious Metal content rather than it legal tender or numismatic value.

Wafer - Gold or Silver, a small bullion bar of typically 10 troy ounces or less is commonly referred to as a "wafer". Click to see a gold wafer.

Gold - A precious yellow metallic element (Atomic Number 79) that is resistant to oxidation and is highly ductile and malleable. Used in coinage, jewelry and industrial applications, Gold has long been used as a store of wealth and a standard for currencies worldwide.

Silver - A soft-white lustrous metal, Silver (Atomic Number 47) has the highest electrical and thermal conductivity of any metal and occurs both in minerals and in free form. It is used extensively in coins, jewelry, tableware and photography. Its chemically active nature causes changes in color or tones when exposed to air and certain elements.

Platinum - A heavy, malleable, ductile, precious, gray-white metal, Platinum (Atomic Number 78) is resistant to corrosion. Platinum is used in jewelry, laboratory equipment, electrical contacts, dentistry and automobile emissions control devices. Platinum coins and bars are now very popular investments.

Palladium - A rare Silver-white colored metal of the Platinum group. Palladium (Atomic Number 46) resembles Platinum chemically and is primarily used as an industrial catalyst and in jewelry.

Precious Metals are considered to be a long term asset.

Gold has proven to have the sustainability to withstand any type of market. Gold is recession proof. As we face another economic standstill, gold remains to be one of the few commodities that will retains its value, allowing you, the investor, to hold onto your wealth through your gold investments.

As we witness global currencies devaluing before our eyes, gold thrives. Many experienced investors reap the rewards of securing their wealth through the purchase of gold- whether through bullion bars, coins or gold stocks.

Whether in the ancient or contemporary times, investing in gold proves to be worthwhile. Gold provides security and wealth.

When considering purchasing precious metals like gold, you are buying into a physical asset. Prudent investors use precious metals such as gold, silver, platinum and palladium to balance their investment portfolio against under performing equities, inflation, and as a hedge against the devaluation of the dollar during periods of economic uncertainty. In recent years we have seen increasing portfolio diversification towards tangible assets such as precious metals. In fact, many portfolio managers suggest that a well diversified portfolio should contain at least 5-15% of physical precious metals.

Bullion is the most liquid form of precious metals. Bullion comes in the form of either bars or coins. Owning physical bullion acts as a hedge against inflationary pressures and devaluation of the U.S. dollar. Should you decide to purchase bullion, you have the choice of taking physical possession of your bullion or having it held in allocated or unallocated accounts.

An unallocated account is an account where specific bars are not set aside and the purchaser has a general entitlement to the metal. It is the most convenient, cheapest and most commonly used method of holding metal. Credit balances on the account do not entitle the purchaser to specific bars of gold or silver, but are backed by the inventory of the depository with whom the account is held.

An allocated account is an account whereby the purchaser requires the metal to be physically segregated and serial numbered. The purchaser’s holdings are identified in a weight list of bars showing the unique bar number, gross weight, the assay or fineness of each bar and its fine weight.

To learn more, call a Cache Metals Specialist Monday to Friday 9 am to 5 pm ET: 1.87.916.6670

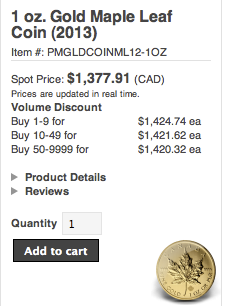

All Precious Metal products include an inherent value based on its metals content in troy ounce weight. A product's sell price is a combination of the current spot price multiplied by its actual metal weight plus a premium.

In today’s global climate of economic uncertainties and shifting geopolitical trends, asset diversification is seen as the preferred strategy for most investors and owning precious metals has been brought into the forefront of the public eye. Holding precious metals in a portfolio gives many distinct advantages in the form of investment gains and providing a hedge against macroeconomic and geopolitical turbulence. Precious metals have also been known throughout the ages as a trusted form of wealth preservation. Used correctly, precious metals holdings can be an effective component of a well diversified portfolio. Many financial professionals maintain that a well balanced portfolio should contain between 5–15% in gold, silver, and other precious metals.

Gold retains its value not only in times of financial uncertainty, but in times of geopolitical uncertainty. It is often called the “crisis commodity”, because people flee to its relative safety when world tensions rise; during such times, it often outperforms other investments. For example, gold prices experienced some of their largest recent movements during periods of tension with Iran and Iraq in 2007 and 2008.

Its price often rises the most when confidence in governments is low.

Owning precious metals can come in various forms. Use Cache Metals’ Guide To Precious Metals Ownership as a simple and transparent way to help yourself to decide which form of ownership works best for you. Download

Cache holds the relationship developed with our clients in the highest regard. Our commitment to our clients always puts their interest first. The services we offer are our greatest advantage; they are customized to your specific financial position and goals. Our clients are treated as individuals, and as such get the personalized attention they expect and deserve.

Caches' diverse team of employees represents one of our greatest strengths. Our dedicated team represents a diverse range of nationalities and languages to provide a wide perspective of thought.

Cache recognizes that research and analysis are key tools for our clients. We strive to consistently provide cutting edge analysis and strategies to keep our clients one step ahead of the game. It is precisely these reasons why many of our clientele come to us by way of referral, which is the ultimate endorsement of our team.

Our Bullion Services Include:

Buy and sell gold, silver, platinum and palladium online or in our Toronto retail store

Best Price Guarantee on Precious Metals

Multiple delivery and storage options

Up to the minute market quotes

Place buy and sell or stop-loss orders

Collateral loan facilities

View accounts online

Regular research reports

Easy access to our bullion specialists

Easily liquidate holdings

Multi-lingual bullion specialists for international clientele

As with all investments, the price of precious metals changes rapidly, and as such should be considered volatile. Upon entering the metals market, the risk of loss is solely that of the client. Only individuals who are capable of sustaining a capital loss should consider purchasing precious metals. Acquisitions in precious metals which are financed are considered high risk