- Call 1.877.916.6670

- Contact Us

The Silver Lining Around China’s Slowing Growth

The Silver Lining Around China’s Slowing Growth

It’s been a stunning run for China. In the space o1f just 10 years, China’s economy has growth to become the second largest in the world, second only to the U.S. But there are signs China’s growth story is starting to wane: last week the Organization for Economic Cooperation and Development (OECD) cut its growth forecast for China in 2013, down to 8.5% from its May estimate of 9.3%. Compared to Europe and the U.S., China’s economy is still doing well – but there are signs of trouble as exports and industrial production begin to slow.

Amidst gathering clouds for China, however, there is a silver lining (literally).

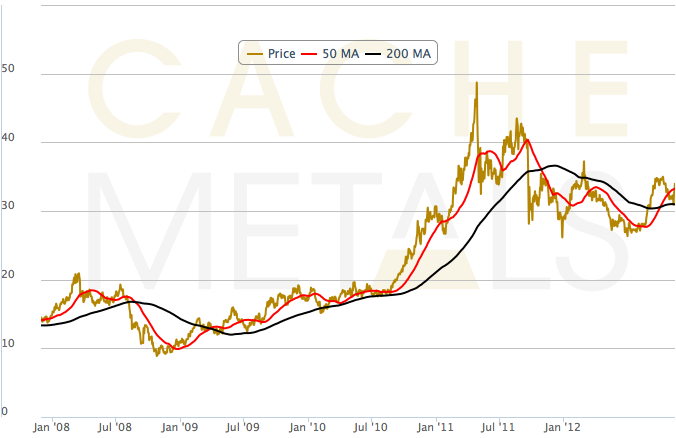

Chinese consumers, worried about China’s growth prospects, are running to hard assets. That means gold… and even more silver. Last year China was the world’s second largest consumer of silver as Chinese consumers drove the price of the precious metal to new highs. This follows on a trend that has been in place since 2008, when the Financial Crisis kicked into gear: in the past four years, silver prices have climbed nearly fourfold, to $34 an ounce today from a low of $8.4587 in 2008.

So while Chinese consumers might be concerned about China’s economy, they are snapping up silver: demand is set to jump by up to 10% next year, with consumption hitting a record high of 7,700 metric tons. (Bloomberg News).

Consumers are a big part of the silver story in China, with instability in the Chinese economy driving them to buy the precious metal as a safe place to stash money in uncertain times. Right now, for example, 33% of China’s silver demand comes from consumers buying jewelry and silver coins. As a less costly alternative to hold, it’s an attractive asset right now.

The bottom line? China is good news for silver prices as Chinese consumers turn to the precious medal as a safe haven in a slowing economy. So while 2012 has been very good to silver, 2013 is looking even more golden for the metal.

Chart: Silver Prices 2008 – 2012

As with all investments, the price of precious metals changes rapidly, and as such should be considered volatile. Upon entering the metals market, the risk of loss is solely that of the client. Only individuals who are capable of sustaining a capital loss should consider purchasing precious metals. Acquisitions in precious metals which are financed are considered high risk