Published by MarketWatch: Friday, Nov 13. 2009 By: Myra P. Saefong

TOKYO (MarketWatch) -- Silver's not so much a poor man's gold anymore and investors may soon realize that the white metal's the real treasure.

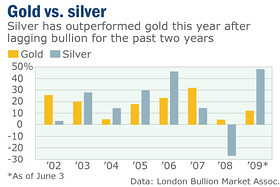

True, at $17 per ounce, silver is cheap -- trading around 60 times less than gold's record price of more than $1,100. But year to date, it's climbed 52% in value compared with gold's rise of around 25%, according to data from FactSet Research.

Silver is a precious metal, after all, one that has historically outperformed gold in a bull market and doubles as an industrial metal -- and supplies of it are depleting at a much more rapid pace.

"Silver is unique in terms of being both a monetary and an industrial metal," the Bullion Services Team at GoldCore said in a recent report, pointing out that it's severely undervalued. "Silver remains the investment opportunity of a lifetime."

Gold's prices have climbed nearly 11% in the last two months. In that same time span, silver's up by only 3.1%.

And "investors looking for returns continue to wager on higher gold prices, whether it be on concerns over equity or currency markets ... or to make quick short-term profits," according to CPM Group's latest Precious Metals

Advisory. But investors would be better served to turn their eye toward silver.

"Silver is highly correlated to the safe haven of gold and is, in effect, a leveraged sister of the precious yellow metal," according to GoldCore, an international bullion dealer. "Thus, informed investors use gold more for wealth preservation purposes and silver in order to make a return."

'Silver remains the investment opportunity of a lifetime.'

Bullion Services Team, GoldCore

That's particularly important to keep in mind as investors change the way they perceive the paper-asset markets.

As stocks, currencies, bonds and other paper assets have begun to disappoint investors, investor attitudes have been shifting, said Mark Leibovit, chief market strategist for VRTrader.com.

"What begins as a trickle ends as a tidal wave when the panic peaks [and] when public revulsion at the U.S. dollar begins, the tidal wave will become a tsunami," he said.

Under that scenario, "silver, far more volatile than gold, will benefit most," he said.

A split personality

Forced to pick just one, Chris Mayer, editor of Agora Financial's Capital and Crisis said he'd rather own gold. Others disagree.

"Silver does not have the same appeal as gold," said Mayer.

"What did India's central bank buy in record amounts ... [and] what did China double its reserves of this year? Gold," he said. "They aren't buying silver."

"It's not like comparing oil with [natural] gas, where you are comparing the energy equivalent of the two and there is some economic incentive when the gaps get very wide to switch to one or the other at the margin," said Mayer. "That doesn't exist with silver and gold."

And when the global industry remains mired in a slow growth pattern, the market's not going to see sky-high prices for a metal whose "lion share of demand comes from its industrial applications," said Jon Nadler, a senior analyst at Kitco Metals. It's really silver's "precious side that is holding it up right now," said Ed Bugos, director of mining finance at Strategic Metals Research and Capital. "Its industrial side would be over valued" with the ratio of silver to other commodities having made new highs.

The investment figures for silver show this loud and clear.

"Silver's allure as an investment is evermore appealing as a hedge against fading fiat currencies that are getting inflated into oblivion," said Scott Wright, an analyst at financial-services company Zeal LLC.

This is "measurable via skyrocketing investment demand" for physical bullion and exchange-traded funds, he said, pointing out that the iShares Silver Trust /quotes/comstock/13*!slv/quotes/nls/slv (SLV 17.60, +0.45, +2.62%) has already increased its holdings by 29% in 2009.

From the start of this year through the end of October, total silver holdings in exchange-traded funds were up 36.3%, according to data from CPM Group.

The sale of silver coins and minted bars also offers a good gauge of demand.

Over at The Perth Mint, total silver ounces sold as coins and minted bars is five times higher in the 2008-2009 year compared with 2005-2006, according to data from the Mint, which is owned by the Government of Western Australia. During the same period, gold ounces sold as coins and minted bars have more than doubled.

U.S. Silver Eagle coin sales were up 72.6% in October from a month ago -- up 106.2% from October 2008, CPM Group data showed.

"Although fabrication demand is important, it is investment demand that tends to have a more dynamic effect on silver prices," said Chintan Parikh, a commodity analyst at CPM Group in New York.

"This is because of the larger dollar volumes of money that can be involved with investment demand, the speed and intensity with which investment demand trends can rise, fall and reverse course, and the ultimately total discretion that investors have over whether they wish to be involved in silver at all," he said.

Fame and fortune

But while some agree that benefits for silver's precious metal characteristics have outweighed the pluses from its industrial uses, that industrial label may soon turn out to be of lesser hardship.

"The industrial uses for silver are numerous and generate substantial additional demand for silver outside its precious metal usage," said Patrick Kerr, managing director at Amerifutures Commodities & Options.

True, silver's suffering from a falloff in demand from the photography world as consumers turn to the digital age, but industries are finding other uses for the versatile metal, including medical applications, and actually consuming supplies as they use them.

"Silver is consumed and gone forever in most applications," said Julian Phillips, an editor at SilverForecaster.com. On the other hand, "huge efforts are made to recover gold, so essentially it is not consumed." "Silver is consumed and gone forever in most applications," said Julian Phillips, an editor at SilverForecaster.com. On the other hand, "huge efforts are made to recover gold, so essentially it is not consumed."

Gold's much higher value prompts great efforts to recycle it. In fact, "all the gold mined in the world ever is still with us, but a huge amount of silver has been used

in photography, mirrors and other industrial uses in the last 200 years," according to the GoldCore report. "The low price of silver makes recovery and recycling uneconomic."

So "industrial demand has been outstripping mining supply for most of the last 20 years, driving above-ground supply to historically low levels" and silver production has been flat in recent years, while demand has been increasing, the report said.

As a result, refined silver stocks are near an all-time low, with stocks dropping from around 2.2 billion ounces in 1990 to around 300 million ounces today, it said.

"At one time, silver was more expensive than gold, but that was in the days of Egypt's Pharaohs," said Phillips.

And while no one wants to say that will ever happen again, most analysts expect that silver prices will soon react to gold's recent gains.

Prices for silver could spike to $18.25 or even $20 between now and December, according to CPM Group.

GoldCore expects to see prices at well over the nominal high of $50 an ounce and, eventually, surpass the inflation-adjusted high of some $130 per ounce in the coming years.

"Ultimately, silver tends to exhibit its largest spurts in the latter stages of a major gold up legs," said Zeal's Wright. "Once speculators and investors start to get excited about this metal, it can really fly -- and fast."

Myra P. Saefong is MarketWatch's assistant global markets editor, based in Tokyo.

Printed on Marketwatch site Article Source |